Check borrowing calculator

If you want a more accurate quote use our affordability calculator. Deposit calculator Mortgage calculator How much can you bid.

Home Loan Eligibility Affordability Calculator

You can also check our.

. If youre looking to consolidate credit cards loans or medical bills PNC has some great options for you. Its important to note the calculator assumes a fixed rate for the entire life of the loan. This is largely made up of your income your financial commitments current savings and your credit history.

The more income you can prove you earn to a lender the greater your borrowing capacity is likely to be. The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be. Use our tool to get an idea of what a home renovation could cost.

Feel free to drop as many Calculator Screen instances as you require into the white area below. PNCs home improvement calculator asks about the age and location of your home the room youre looking to add or improve and some details about the scope and depth of. It is a type of reverse mortgage.

Leasing a Car and How to Lease a. Disclaimer - Borrowing power. Check out our full guide to how much mortgage you can borrow.

The bi-weekly payments are set to half of the original monthly payment which is like paying an extra monthly payment each year to pay off the loan faster save on interest. Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc. Then explore borrowing options to find your best financing choice Estimate the Cost of a Renovation Project.

Accessibility statement Accesskey 0 Skip to Content Accesskey S. Find out how much you can borrow using our mortgage borrowing calculator simply by answering a few questions. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost of.

Check out Buying vs. FHA home loans require just 35 down and are ultra-lenient on credit scores and employment history compared to other loan types. Example of how to calculate LVR.

You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home. Speak to an expert. Thus you will find the ROI formula helpful when you are going to make a financial decision.

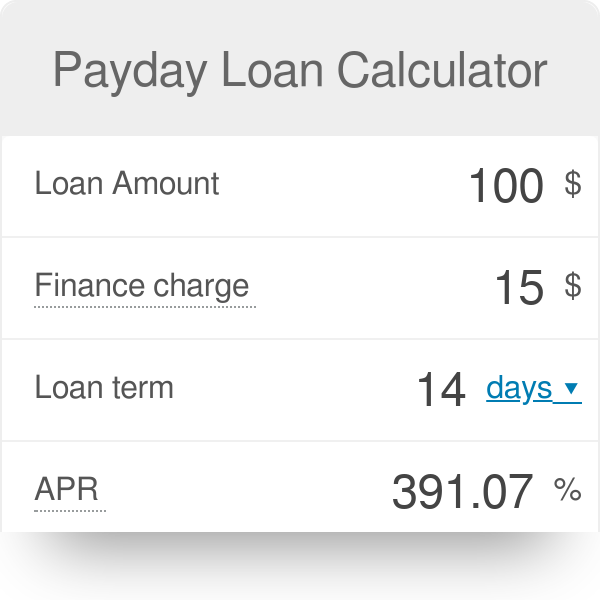

This is called your borrowing power. But that doesnt mean it is the cheapest way to borrow. A no-credit-check loan can seem like the only way to get cash fast if you have a low credit score or no credit history.

The borrowing amount is a guide only. The amount you may be able to borrow is determined by your financial situation. Are the tax scales current.

Call us on 1300 889 743 or complete our online enquiry form and we can let you know your borrowing power. Our buying power calculator helps you estimate your maximum property purchase price. The calculator also doesnt factor in interest rate fluctuations.

Rates and repayments are indicative only and subject to change. You may be able to take control of your spending by paying down debt faster or lowering your monthly. Down payment residual value estimated sales tax money factor and lease term into the lease payment calculator youre going to get your monthly lease payment.

Use our mortgage borrowing calculator to find out how much mortgage you could borrow to buy a property based on your income and whether youre buying with anyone else. This calculator helps you work out the most you could borrow from the bank to buy your new home. Looking for more insight from a borrowing power calculator.

A new car lease is simply another way of borrowing money to pay for a car. Check Eligiblity You Can Live Well at Home. But this type of loan may come with risks including triple-digit interest.

Estimate your borrowing power. Youll also need to consider your spending habits and any existing commitments such as personal or car loans. Try our Borrowing Power Calculator and find out how.

Estimate how much you can borrow for your home loan using our borrowing power calculator. View your borrowing capacity and estimated home loan repayments. This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis.

This is the money you pay each month to. Our return on investment calculator can also be used to compare the efficiency of a few investments. Personal loan borrowing power calculator.

Our home loan borrowing power calculator could help you work out what you may be able to afford to borrow from a financial institution based on your income and expenses. Check out 5 Ways To Borrow At A High LVR to do just that. If you borrow 900000 against a property valued at 1000000 then what would your LVR be.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. ROI calculator is a kind of investment calculator that enables you to estimate the profit or loss on your investment. We calculate this based on a simple income multiple but in reality its much more complex.

Ready to apply for a home loan. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years. How your income and expenses can impact your borrowing power.

Check Your FHA Mortgage Payment. There are many 0 deals on new borrowing. Use our debt consolidation calculator below to see how consolidating debt can impact your financial future.

The big advantage is that you have fixed payments in other words you know how long you are borrowing for and how much you have to repay each month which helps you remain disciplined. The order of the screens. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings.

Our buying power calculator gives you an idea of the maximum you could spend on a property in minutes. Check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. We regularly update the calculator with current tax scales to make sure that the.

There are many alternatives - for example credit cards. A Household Loan is our innovative approach to borrowing against home equity for responsible long-term retirement funding. Youll need to spend a little longer on this.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the.

Borrowing Power Calculator Homestar Finance

Loan Calculator That Creates Date Accurate Payment Schedules

Borrowing Power Calculator How Much Can I Borrow Me Bank

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Loan Calculator That Creates Date Accurate Payment Schedules

Business Loan Calculator Step By Step Guide Examples

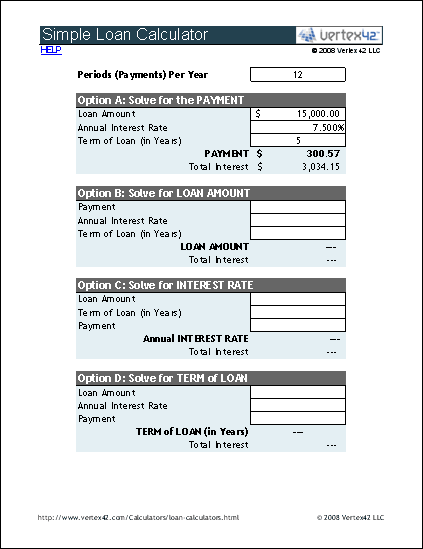

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Home Loans Calculator Sale Online 55 Off Www Wtashows Com

Loan Calculator Free Simple Loan Calculator For Excel

Loan Calculator Credit Karma

Loan Calculator Netherlands Abn Amro

Loan Calculator Netherlands Abn Amro

Mortgage Calculator Netherlands 2022 Abn Amro

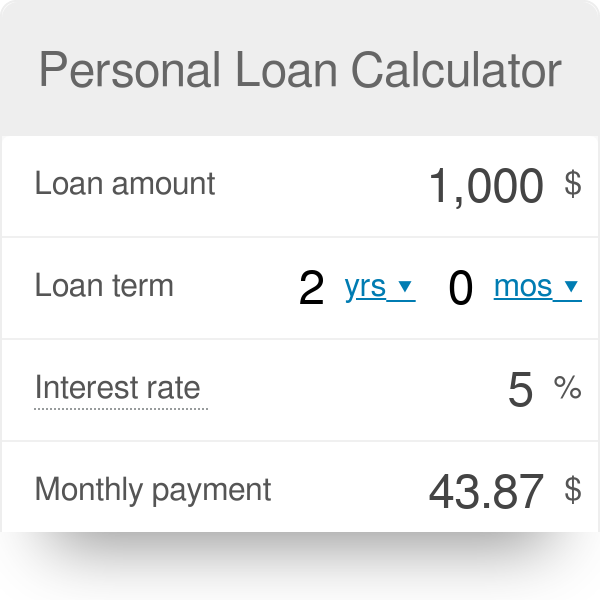

Personal Loan Calculator

Payday Loan Calculator

Lvr Borrowing Capacity Calculator Interest Co Nz

Va Loan Calculator